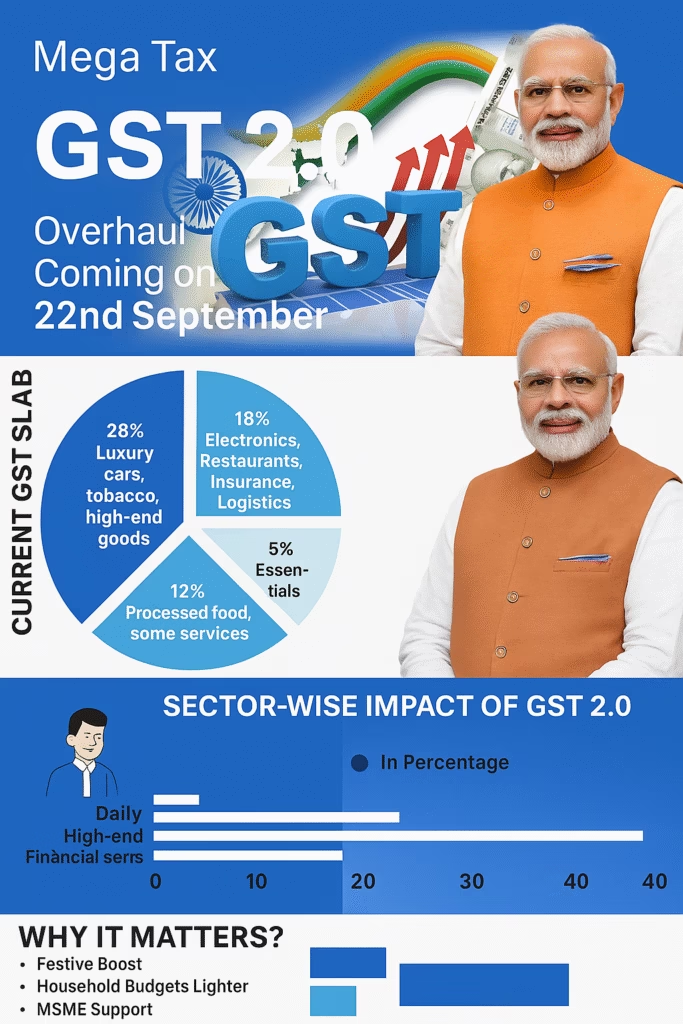

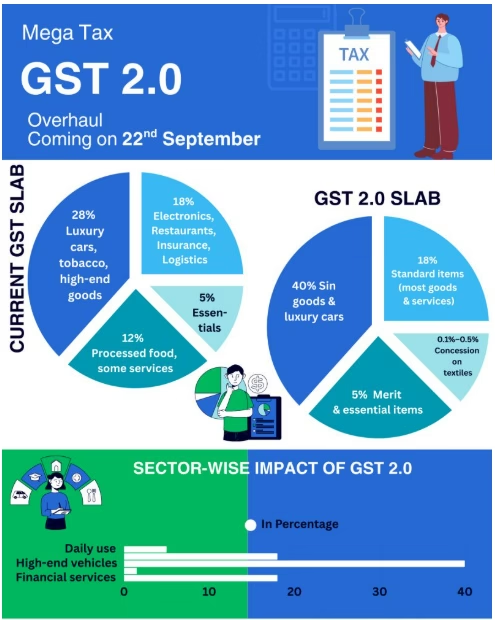

GST changes India 2025 bring a new two-slab system—5% and 18%—plus a 40% luxury tax. Learn how GST 2.0 impacts essentials, real estate, automobiles, and insurance.

What is GST 2.0 and Why is it Important?

India is preparing for one of the biggest tax reforms since 2017 with the launch of GST 2.0. From September 22, 2025, the new GST system will simplify taxation, reduce prices on essentials, and boost consumer demand. The reform was announced by Finance Minister Nirmala Sitharaman after the 56th GST Council meeting.

The timing of these GST changes in India 2025 is strategic, coinciding with Diwali and Navratri festivals, and just months before key state elections.

GST Changes India 2025: From Four Slabs to Two

Until now, GST had four major tax slabs—5%, 12%, 18%, and 28%. This complex system created compliance challenges for businesses.

With GST 2.0, India now moves to:

- 5% Slab – Essentials like food, medicines, EVs, and personal care items.

- 18% Slab – Consumer durables, cement, small cars, and apparel above ₹2,500.

- 40% Luxury/Sin Slab – Premium cars, alcohol, tobacco, and luxury goods.

This simplified GST structure will make the system more transparent, predictable, and consumer-friendly.

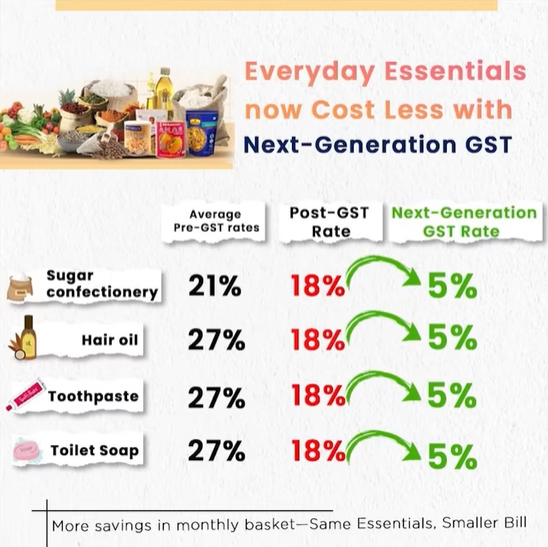

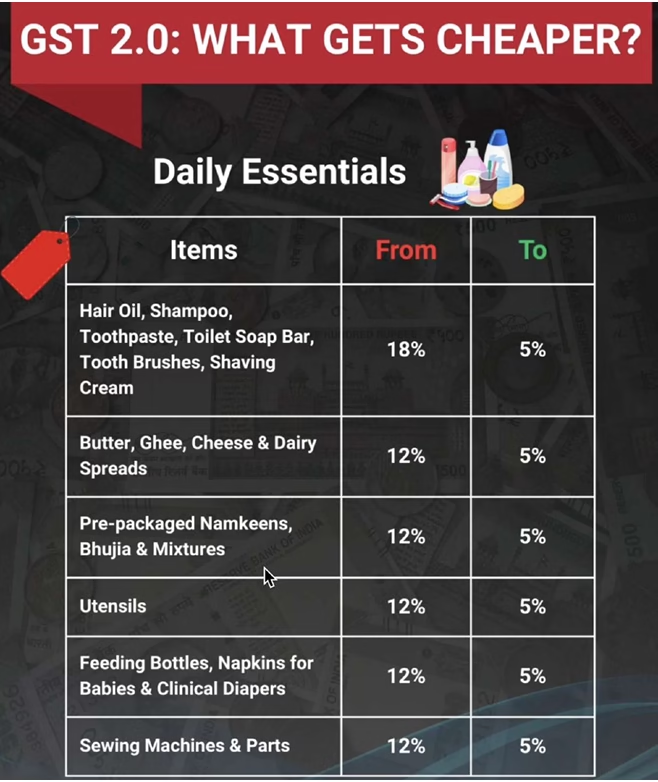

GST Rate Cut Benefits for Consumers

One of the biggest advantages of GST 2.0 is the relief on essential goods and services. Everyday household products such as soap, toothpaste, shampoo, hair oil, packaged foods, and life-saving medicines will now attract only 5% GST or no tax at all.

Another major win for consumers is the removal of GST on health and life insurance premiums. With healthcare costs rising, this change will encourage more families to buy insurance, increasing financial security across the country.

For the middle class, these measures serve as a much-needed Diwali gift from the government.

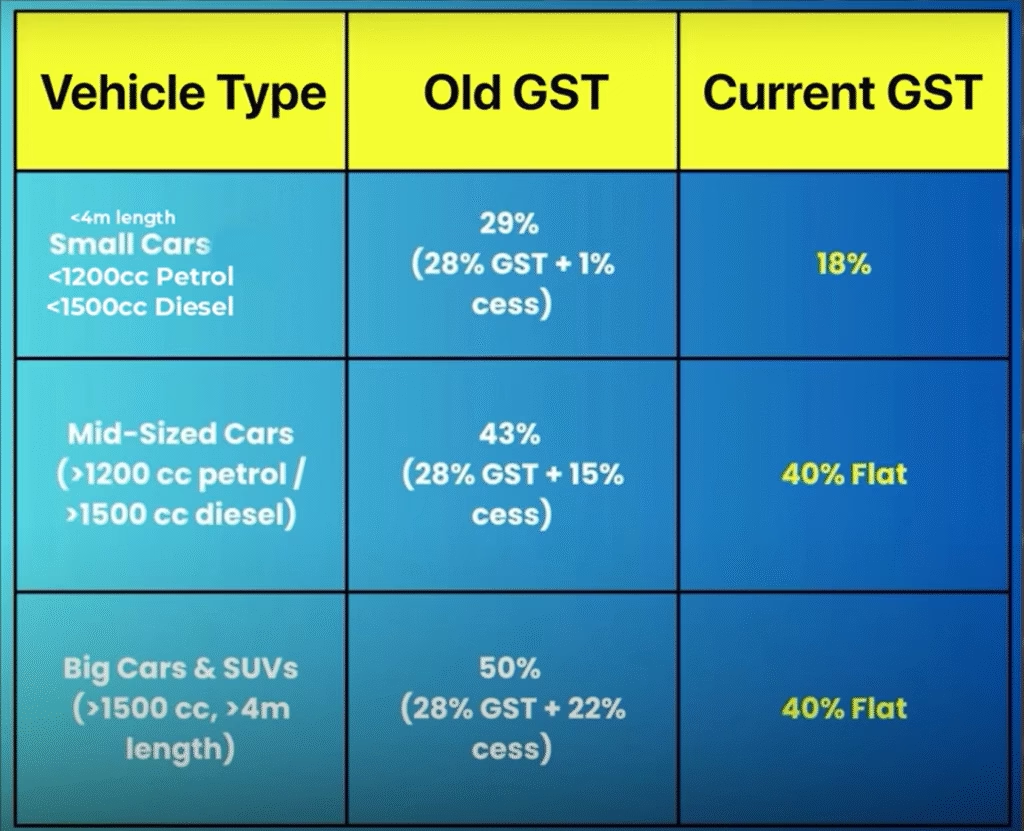

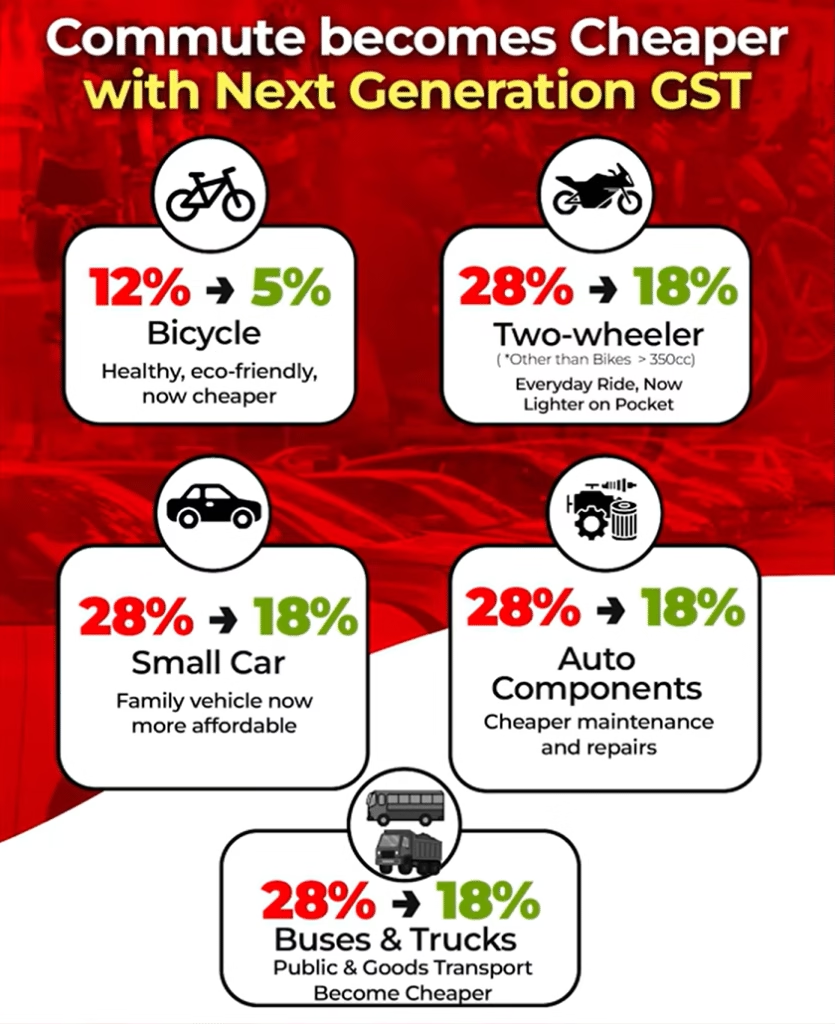

Impact of GST 2.0 on Automobiles and Consumer Durables

The automobile sector is one of the biggest winners of GST changes in India 2025.

- Small cars will now be taxed at 18% instead of 28%, making entry-level vehicles more affordable.

- Appliances like TVs, refrigerators, air conditioners, and washing machines are also moved to the 18% slab, cutting prices significantly.

- Cement and construction inputs now attract 18%, down from 28%, reducing building costs.

- Electric vehicles (EVs) remain under the 5% GST slab, reinforcing India’s green mobility mission.

This reduction is expected to boost demand for automobiles and appliances, especially during the festive season.

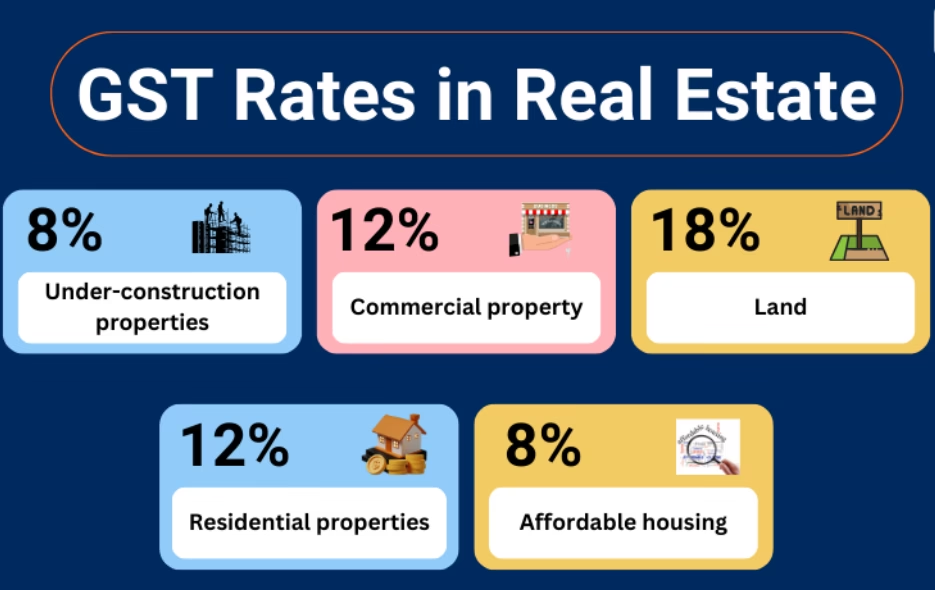

Impact of GST 2.0 on Real Estate and Construction

The real estate sector has long demanded lower GST on construction materials, and GST 2.0 finally delivers.

- Cement has dropped from 28% to 18%.

- Granite and natural stone are now taxed at just 5%, down from 12%.

This will make housing projects cheaper and more attractive to buyers. Developers expect an uptick in new projects, while homebuyers will benefit from reduced costs. Overall, the impact of GST 2.0 on real estate is expected to be highly positive, supporting the government’s affordable housing vision.

Economic Impact of GST Reforms 2025

While these reforms reduce tax collections by nearly ₹480 billion (about $5.5 billion), economists argue the long-term benefits are greater:

- Inflation relief – Expected to drop by up to 1.1 percentage points.

- GDP growth boost – Likely to increase by 100–120 basis points in the next few quarters.

- Stock market gains – Shares of consumer goods, real estate, and automobile companies surged after the announcement.

These GST reforms in India 2025 are designed to stimulate consumption, which in turn will drive economic growth.

Winners and Losers of GST Changes in India 2025

Winners:

- Consumers – Cheaper groceries, medicines, and insurance.

- Real estate developers – Lower construction material costs.

- Auto and appliance makers – Higher demand expected due to reduced GST.

- Insurance sector – More families buying health and life coverage.

Losers:

- Luxury brands – Facing a steep 40% GST rate.

- Mid-range apparel companies – Garments above ₹2,500 now attract 18% instead of 12%.

Political Significance: A Festive Season Strategy

The government has smartly positioned GST 2.0 as an “early Diwali gift” to Indian families. Beyond economics, this reform is seen as a political move to win public goodwill before state elections.

While critics warn about fiscal risks, most agree that the reform will boost consumer confidence and festival spending.

GST 2.0 as a Gamechanger for India

The launch of GST 2.0 on September 22, 2025, is a milestone in India’s tax journey. By simplifying slabs, making essentials cheaper, and reducing construction and automobile costs, the government has delivered reforms that directly impact consumers.

For businesses, GST 2.0 brings greater clarity and stronger demand. For households, it offers financial relief and savings. And for the economy, it provides the fuel needed for growth, investment, and consumption.

As India celebrates the festive season, GST changes in India 2025 could mark the beginning of a new era of simplified taxation and stronger consumer spending.